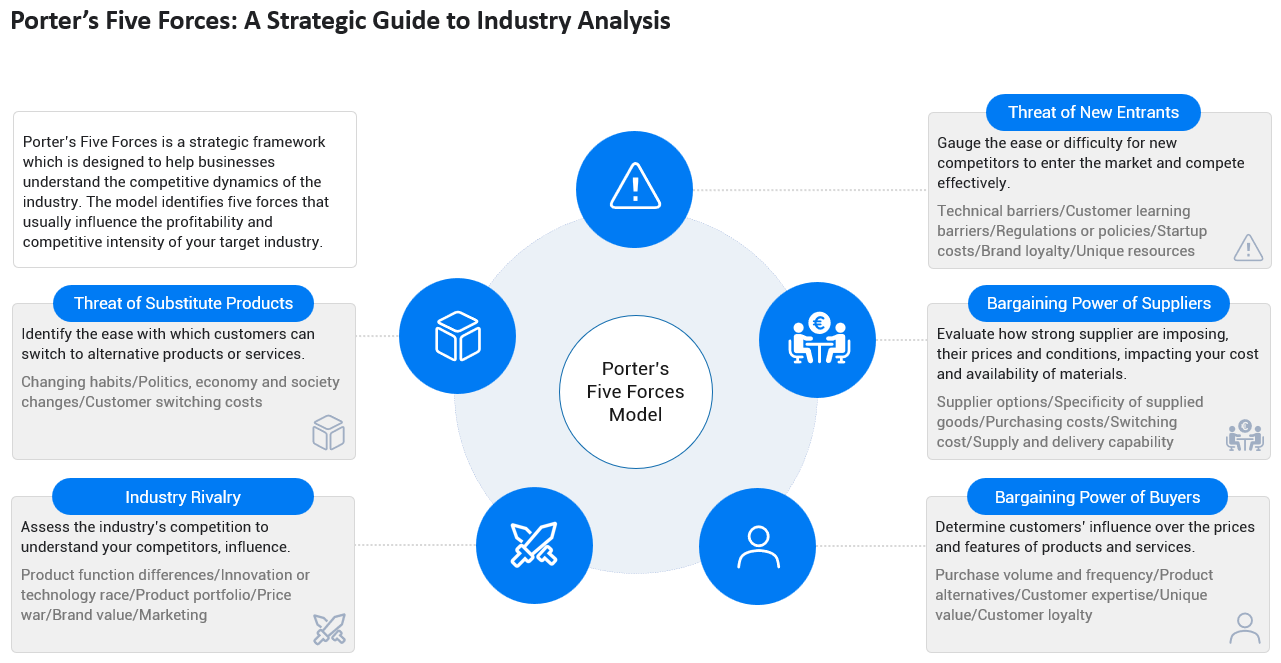

A strategic lens to analyze the 5 distinct forces that determine industry profitability.

The "Rules of the Game"

Porter's Five Forces is a strategic framework developed by Michael E. Porter, a professor at Harvard Business School. He introduced it in his 1979 book Competitive Strategy: Techniques for Analyzing Industries and Competitors.

It is designed to help businesses understand the underlying competitive dynamics of an industry and make better strategic decisions. The model identifies five forces that shape profitability and competitive intensity.

These forces help you see who holds power, where potential threats lie, and which opportunities you can tap into.

What is the 5 Forces Framework

The model identifies five distinct forces that shape every market. It is based on a simple economic idea: competition is not just about rivals, but about structure.

By analyzing these forces, a company can predict industry trends, decide whether to enter a market, and position itself to defend against competitive pressures.

The Five Forces Deep Dive

Let’s explore each of the five forces and understand how they shape your industry. These forces work together like pieces of a puzzle, giving you a full picture of your competitive environment.

Threat of New Entrants

This force is all about the likelihood of new players entering your market. Gauge the ease or difficulty for new competitors to enter the market and compete effectively.

Factors to Consider:

- Technical barriers

- Customer learning barriers

- Strict regulations or policies

- High startup costs

- Strong brand loyalty

- Unique resources

When barriers to entry are low, it’s easier for competitors to jump in and share the profits, please expect increased competition and tighter profit margins.

Bargaining Power of Suppliers

Suppliers are the backbone of your operations, providing the resources you need to create your products or services. Evaluate how strong supplier are imposing their prices and conditions, impacting your cost and availability of materials.

Factors to Consider:

- Supplier options (the more options you have, the stronger position to negotiate favorable deals)

- Specificity of supplied goods

- Purchasing costs

- Switching cost

- Supply and delivery capability

Bargaining Power of Buyers

This force examines how much influence your customers have over your products and services.

Factors to Consider:

- Purchases volume and frenquecy

- Product alternatives

- Customer expertise

- Unique Value (tangible and intangible)

- Customer loyalty

If there are many alternatives in the market or if your buyers are highly price-sensitive, they can push you to lower prices. However, offering unique value or creating loyal customer relationships can help you reduce their bargaining power.

Threat of Substitute Products or Services

Substitutes are alternatives that solve the same problem for your customers. So this force is to identify the ease with which customer can switch to alternative products or services.

Factors to Consider:

- Changing habits

- Politics, economy and society changes

- Customer switching costs

If substitutes are more affordable, convenient, or innovative, you risk losing market share. Identifying and differentiating your offering can help you stay ahead of substitutes and retain customer loyalty.

Industry Rivalry

Assesses the intensity of competition and understand your competitors' influence in your market.

Factors to Consider:

- Product function differences

- Innovation or technology race

- Product portfolio

- Price war

- Brand value

- Marketing

When to Use Porter’s Five Forces

Use this framework to evaluate strategic moves in these contexts:

- New Market Entry: Before launching a product line or entering a new geography. If all 5 forces are "High," the market is likely a "red ocean" with low profitability.

- Corporate Strategy: When redefining your unique value proposition. Use the model to find a position in the industry where the forces are weakest.

- Risk Assessment: To monitor changes in the landscape (e.g., "Has the supplier power increased due to consolidation?").

Takeaway

Porter’s Five Forces serves as a lens to "zoom out" and view not only your direct competitors but the broader dynamics shaping your business landscape. It’s like mastering the "rules of the game" in your industry, enabling you to compete with sharper focus and smarter strategies.

By understanding where power truly sits in an industry, you can make smarter entry decisions, defend margins, and avoid fighting battles you cannot win.

Template

Get into the real practice now.